The Impact of Automatic Contributions Explained

The 401(k) is one of the best available retirement savings options for Americans, yet of the 59% who have access to this retirement savings vehicle, only 32% are investing in one, according to the U.S. Census Bureau. This fact causes one to question how many people truly understand the impact automatic contributions can have on retirement savings, and the magic of a not so little thing called compounding. The truth of the matter is that there really is no magic at all; those who are already members of this camp are simply exercising discipline by saving money, contributing regularly to their retirement account, and harnessing the power of compounding over time. So, what is compounding exactly? Compounding is when an investment earns a return, and the gains on the initial investment are reinvested and begin to earn their own returns.

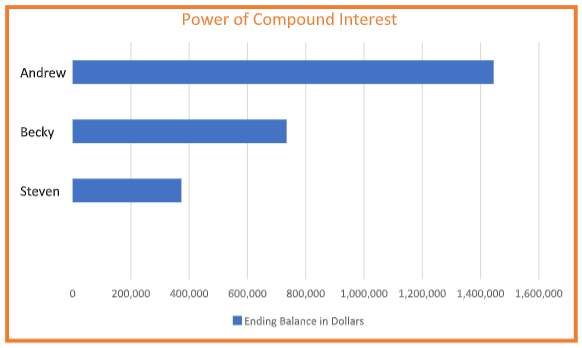

Take some time to explore this example and the astounding results:

Three individuals decided to start putting away $1,000/month in an investment account for ten years where it accrued at a rate of 7%. Each one of them left the balance in their account to grow until age 65. Andrew started saving at age 25 and saved for ten years, Becky didn’t start saving until age 35 and saved for ten years, and Steven didn’t start saving until age 55 and also saved for ten years. All three of them saved the same amount of $120,000 over the same time period of ten years. However, the ending balance was dramatically different.

| SAVER | ENDING BALANCE |

|---|---|

| Andrew | $1,444,969 |

| Becky | $734,549 |

| Steven | $373,407 |

This illustration makes it quite clear that time is the most powerful variable an investor has working for them.

More Matters

The more money you stash away, the larger the investment gains that money will produce over time. Keep in mind, even if you can’t contribute the maximum needed to get the company match, contribute whatever you can, and strive to work your way up to a higher savings rate. The size of your contribution really does matter. Consider the following example:

A 25year-old increases his annual savings rate from 10-12%/year and as a result would have a little under $1,000,000 as he enters retirement. If he increases his savings rate to 15%, he will end up with just over $1,200,000, which is $370,000 more!

This example also supports the case for auto escalation – a plan feature that automatically increases participants’ contributions each year up to a specified limit. 58% of large plans use auto escalation versus 40% of small plans. Most plans that offer this feature, increase participant deferrals by 1% per year. According to a recent survey from the Defined Contribution Institutional Investment Association (DCIIA), in plans with neither automatic enrollment nor auto escalation, only 44% have savings rates above 10%. In plans that utilize automatic enrollment only, this percentage increases to 67%. Where plan sponsors have implemented both automatic enrollment and auto escalation, that percentage rises to 70%.

Here is an excellent example of auto escalation at work:

Jack and Joe are both 401(k) savers at age 25 who earn $40,000/year and contribute 6% of their pay to their plan. Both receive a 2% raise each year and earn 6% rate of return on their investments. Jack chooses auto escalation, so his contribution rate increases by 1% each year and maxes out at 15% of his salary. By age 65, Jack would have more than $1.1 million. Joe, who didn’t utilize auto-escalation only saved about $513,000.

How to Save More

For many, it isn’t that they don’t want to save more towards their retirement, it is that they aren’t sure how to go

about doing it. We often say, it is the little things that can make all the difference, and this is no exception.

- Review your cash flow and identify areas where you can cut back (eat out less, find activities that are free or low cost).

- Review your monthly bills and determine if there are better deals/rates.

- Check your credit card statements to determine if there are any subscriptions you can eliminate.

If there are savings available here, apply them to your contribution initiative.

- Open/enroll in a retirement account (401(k), 403(b), traditional IRA, Roth IRA).

- Have a portion of your paycheck sent directly to your retirement account (Ideally at least 10% of your pre-tax income, but if you can’t do that much, do whatever you can).

- Implement auto escalation so your contribution rate increases every year.

- Take advantage of your employer’s match, if available.

Automatic contributions are a retirement savings plan’s most valuable tool. It is a time- tested proven, effective strategy for building retirement wealth. If you aren’t already doing this, start now!

Money Under 30. (May 2021). If You Still Don’t Believe in the Power of Compound Interest, You Have to See This.

https://www.moneyunder30.com/power-of-compound-interest

U.S. News. (June 2017). Build a Better 401(k) Balance with Auto-Escalation.

https://money.usnews.com/investing/articles/2017-06-23/build-a-better-401k-balance-with-auto-escalation

Kiplinger. (November 2020). How to Automate Your Savings in 6 Easy Steps.

Main Street Advisors, LLC. June 2021. Main Street Advisors, Inc. is a Registered Investment Advisor. The articles and opinions expressed in this material were gathered from a variety of sources, but are reviewed by Main Street Advisors, LLC, prior to its dissemination. All sources are believed to be reliable but do not constitute specific investment advice. The views expressed are those of the firm as of June 2021 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice. Any advice given is general in nature and investors must consider their own individual situation. Always contact your financial/investment professional before making any financial decisions. Main Street Advisors, LLC is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.