Debt Paydown Strategies

Debt is an adversary that many of us contend with on a daily basis; it can destroy marriages, cause health issues, and threaten the financial security of those caught in its crosshairs. As of September 2021, consumer debt is at $14.96 trillion with the average American debt among consumers at $92,727. The overall debt figure includes credit card balances, student loans, mortgages and more. American households are carrying debt in record numbers as home and auto prices surge, inflation continues to take a toll on wallets, and people brush the dust off their credit cards and start spending once again. The numbers tell the story:

- In July through September, US household debt climbed to a new record of $15.24 trillion, according to the Federal Reserve Bank of New York. It was an increase of 1.9%, or $286 billion, from the second quarter of the year.

- Credit card balances rose by $17 billion, just as they had during the second quarter.

- Mortgages rose by $230 billion last quarter and totaled $10.67 trillion.

- Auto loans and student loan balances also increased, rising by $28 billion and $14 billion, respectively.

No matter which type of debt is chasing you while you dream at night, there are many different strategies you can use to pay down your debt, or better yet, pay it off completely. Do it for your health, your happiness, your credit score, and your peace of mind. The first step is taking a step back and look at the aerial view of your financial situation. It is crucial you know what your total debt owed is. Write down the balance owed on each debt along with the corresponding interest rate and monthly payment. Begin prioritizing which debts you would like to pay off first and number them. Keep this list along with your overall financial goals somewhere you can visually see them every day. Consider the following strategies in your debt paydown plan:

Pay high interest rate debt off first

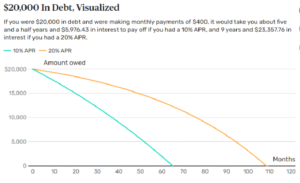

The debts carrying the highest interest rate are hurting you the most over time, as interest charges will rack up fast. This chart from Smart Balance does an excellent job of displaying this. A solid understanding of the role interest rates play in consumer debt is crucial when trying to dig yourself out of a financial hole.

Make additional payments

Pay your credit card bill more often. Instead of monthly, try every two weeks. Doing this lowers your principal balance and can save you interest. For example, if your credit card company calculates the finance charge using the average daily balance method, you will pay a lower finance charge by sending another payment earlier in the billing cycle. Making multiple payments in a billing cycle also helps your credit utilization—the ratio of your credit card balance to its credit limit. The lower your balance is relative to the credit limit, the better it is for your credit score.

If you receive a bonus, income tax refund, or other infusion of money, you can make a lump-sum payment since there are no prepayment penalties to pay off credit card debt.

Balance transfer cards

Balance transfer cards are used to move the balance from one credit card (with a higher interest rate) to another (typically with a 0% or exceptionally low rate) to pay down debt. To qualify for one, you will need a good credit score of 690 or higher. You can transfer a significant amount of your balanced owed to this new card with 0% or other extremely low rate. This low rate is typically in place for anywhere between 6 and 28 months. After this period, standard rates will apply. Be sure to do your homework so you know what the standard rate will be. Most balance-transfer cards charge a balance transfer fee as well, which tends to be between 3% – 5% of the total amount you are transferring over.

Negotiate rates

When it comes to credit cards, all you have to do is call the credit card company and ask them to lower your rate. Sometimes they will do it and other times they will not. There are resources that can help you learn how to negotiate debt with your credit card company.

When it comes to your mortgage, the only way to reduce your rate is to refinance. Refinancing may or may not make sense for you. It will depend on several factors such as how long you intend to stay in the home, costs associated with the refinance such as application fees, underwriting fees, appraisal fees, and origination fees. It will also depend upon the difference between your current rate and the potential new rate. There are many calculators available online to assist with determining whether refinancing is right for you.

Snowball Method

The idea behind the Snowball method is that as you pay down the smaller debts first, and make only the minimum payments to the other debts, you are achieving a sense of accomplishment that provides further momentum to tackle the larger debts next.

For example, perhaps you have a $200 credit card with 15.99% APR, $5,000 credit card with 17.99% APR, $4,000 credit card with 10% APR, $20,000 student loan with 5.25% APR and a $15,000 car loan with 2.99% APR. Using the debt snowball method, you would pay off the debts in the following order:

- $200 credit card with 15.99% APR

- $4,000 credit card with 10% APR

- $5,000 credit card with 17.99% APR

- $15,000 car loan with 2.99% APR

- $20,000 student loan with 5.25% APR

If you paid off the two smallest first, you would be left with only three debt obligations. Now that you have paid off the smaller two, you can apply whatever payments you had been making to those debts to the next one in line.

Debt Avalanche Method

This method involves making minimum payments on all debts, then using any remaining funds to pay off the debt with the highest interest rate. The debt avalanche strategy is very popular because it saves the most money on interest. It is most often used with high-interest debt. It is especially helpful for tackling credit card debt. Success depends on your ability to limit spending and whether you are willing to put as much as possible towards debt payments.

For example, if we used the same example reference above, using this avalanche method, you would pay off the debts in the following order:

- $5,000 credit card with 17.99% APR

- $200 credit card with 15.99% APR

- $4,000 credit card with 10% APR

- $20,000 student loan with 5.25% APR

- $15,000 car loan with 2.99% APR

Remember, you would be making the minimum payments on all of them and using any remaining funds in your cash flow to pay off the debt with the highest interest rate. Having a budget and knowing how much you have available to apply is paramount with this strategy.

Debt Consolidation

If you have several debts that are becoming difficult to manage, there are debt consolidation options. Debt consolidation is the process of combining several debts into one monthly bill on a streamlined payoff plan. Some work as secured loans, such as a home equity loan or line of credit and others are unsecured loans, which means they will carry a higher interest rate. Home equity loans have been used to roll multiple debts into one at a low interest rate. The lower rates combined with the deductible interest make this a favorable option for many. However, keep in mind this tactic reduces your home equity and doesn’t do anything to change your spending behavior, which is the key to ensuring you don’t end up in the same debt spiral again.

Debt is a hot topic, especially around the holidays. Creating a plan with specific and measurable goals to decrease or eliminate debt will help you stay organized, focused, and hold you accountable. Your future self will thank you!

For more information on debt paydown strategies, give us a call today at (410) 840-9200 or visit us at www.mainstadvisors.com

Sources:

Bankrate. (September 2021). Average American Debt 2021.

Average American Debt | Bankrate

CNN. (November 2021). Americans Have Never Been in So Much Debt.

US household debt climbed to a new record of $15.24 trillion last quarter – CNN

The Balance. (October 2021). The Role Interest Rates Play in Consumer Debt.

The Role Interest Rates Play in Consumer Debt (thebalance.com)

The Balance. (October 2021). Reasons to Make Multiple Payments During a Credit Card Billing Cycle.

Benefits of Making More Than One Credit Card Payment (thebalance.com)

Debt.org. (October 2021). Balance Transfer Credit Cards.

What is a Balance Transfer Credit Card & How Do They Work? (debt.org)

Forbes. (July 2021). The Debt Snowball Method: How It Works and How to Use It.

The Ascent (Motley Fool). (Sept. 17). How Does the Debt Avalanche Method Work?

How Does the Debt Avalanche Method Work? | The Ascent (fool.com)

Main Street Advisors, LLC. November 2021. Main Street Advisors, Inc. is a Registered Investment Advisor. The articles and opinions expressed in this material were gathered from a variety of sources, but are reviewed by Main Street Advisors, LLC, prior to its dissemination. All sources are believed to be reliable but do not constitute specific investment advice. The views expressed are those of the firm as of November 2021 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice. Any advice given is general in nature and investors must consider their own individual situation. Always contact your financial/investment professional before making any financial decisions. Main Street Advisors, LLC is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.