7 Smart Year-End Financial Moves

There’s still time to make some smart tax moves before we say farewell to 2021. The story of 2022 has yet to be written. However, legislative and tax law changes are always a possibility. Year-end is the perfect time to do some strategizing where taxes are concerned. So, if you are hoping to cut your tax bill by reducing your 2021 income taxes, consider these 7 smart year-end financial moves.

Make contributions to your retirement accounts

Contributing to your 401(k) can save you a substantial amount of money on your 2021 return, but you must contribute to your plan by December 31st. The 401(k)-contribution limit for 2021 is $19,500. Those age 50 and older can contribute an additional $6,500 catch-up contribution for a total of $26,000. These additions to your plan could decrease your 2021 tax bill significantly.

Money contributed to your IRA may be partially or entirely tax deductible (depending on your situation) thereby reducing your taxable income, and the interest earned while the money is in the account is tax free. Your modified adjusted gross income (MAGI) and your filing status are key in determining the deduction amount you can take. There are also income phaseouts to note. Typically, you have until April 15th to contribute to your IRA. For 2021, you can contribute a total of up to $6,000 to all your IRAs (traditional and ROTH). If you’re age 50 or older, you can make a catch-up contribution of another $1,000 for a total of $7,000.

Consider increasing your contribution rate at year-end. Many plans allow you to set your contribution to increase automatically at a time of your choosing. It’s one of the easiest moves you can make to improve your financial future. At the very least, you should contribute enough to your 401(k) to get your employer match.

Check your withholding

Unexpected tax bills can be avoided! If you switched jobs, earned more due to a raise or bonus, lost your job and received unemployment benefits, or earned income on a side gig, you could pay the price (and that price may be substantial) if you didn’t adjust your withholding. You could also run into problems if you are self-employed and didn’t pay enough in quarterly taxes during the year. Typically, taxpayers must pay at least 90% of the current year’s tax owed or 100% of last year’s tax liability to avoid penalties and interest. If they owe less than $1,000 in tax after subtracting their withholdings and credits, they will also avoid penalties and interest. This rule is slightly adjusted for high-income taxpayers. If your adjusted gross income on the previous year’s return is over $150,000 ($75,000 if you are married filing separately), you are required to pay the lower of 90% of the tax shown on the current year’s return or 110% of the tax shown on the return for the previous year.

There is still time to ask your HR department to withhold an extra amount from your remaining 2021 paychecks or send additional money to the IRS for estimated quarterly payments if you are short. You can also check your withholding with the IRS withholding estimator on the IRS website.

Review tax loss harvesting opportunities

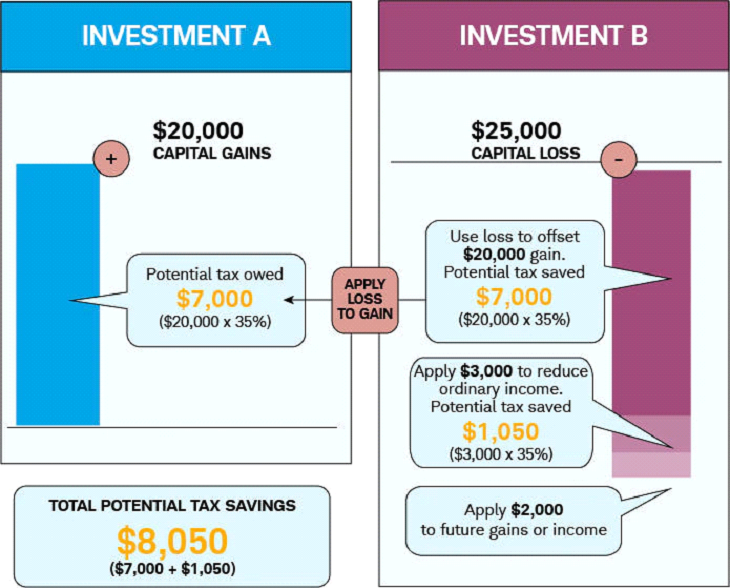

Do you have realized capital gains in taxable accounts this year? You can sell investments that are underperforming and losing money. Then, you use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of your ordinary income (see Schwab’s example below). After that, you can reinvest the money from the sale into a different security that aligns with your investment needs/strategy. You can also carry forward short-term losses for future use. Investors must be aware of the wash rule, which prohibits selling an investment for a loss and replacing it with the same or similar investment 30 days before or after the sale. If you do have a wash sale, the IRS will not allow you to write off the investment loss.

Make charitable donations

If you are 70 ½ or older, you can give money to charity using your IRA. If you are 72 or older, you are required to make required minimum distributions (RMDs) even if you don’t need the money. Many retirees aren’t aware you can donate all, or a portion of their RMD directly to charity. This is referred to as a qualified charitable distribution (QCD). The Secure Act raised the RMD age for some taxpayers to 72, but didn’t raise the QCD age from 70 ½, so if you are 70 ½ or older, you are eligible. QCDs are excluded from your taxable income. This can help prevent your income from reaching the thresholds for the net investment income tax and from disqualifying you from claiming other tax breaks. Using a QCD to reduce RMD could avoid higher taxation on social Security benefits and keep Medicare premiums in check for 2022.

Yet another strategy is the Donor-advised fund. This is a dedicated account for charitable giving purposes. You are eligible for an immediate tax deduction when you contribute to a charity that sponsors a donor-advised fund. You can recommend grants to IRS – qualified public charities and invest the funds for tax-free growth. These funds provide benefits regarding income, capital gains and estate taxes. For those who are charitably inclined and on the fence between taking the standard deduction and or itemizing, there is a strategy that can potentially maximize tax benefits by concentrating charitable contributions and itemizing deductions in some years, then taking the increased standard deduction in other years. This strategy is referred to as “bunching.”

Determine if you want to itemize

With the standard deduction for the 2021 tax year sitting at $12,550 for single filers and $25,100 for joint, many are sticking with the standard deduction. If you think you would benefit more from itemizing, now is a good time to gather receipts and paperwork for the accountant.

Review your credit report

Your credit history is crucial as it determines someone’s creditworthiness. Financial institutions and lenders use it as a guide to determine how much credit they can offer a borrower and at what interest rate. The better the score, the better the offer you get. You can check your FICO credit score for free through Experian.

It is a good practice to pull your credit report yearly. You can get a free copy of your report from each of the three credit bureaus through Annual Credit Report. You can get a free copy of each report once every 12 months. Be sure to address any errors.

Review your health insurance

November is usually the month when open enrollment presents itself. Review your existing insurance carefully and don’t just select the same plan without putting any thought into it. Your health needs may differ from the previous year. Perhaps you are able to take advantage of a high deductible plan with health savings plan (HSA) option. The contribution limit for 2021 is $3,600 for individuals and $7,200 for individuals with family coverage. This money is tax deductible and rolls over from year to year. Open enrollment for the marketplace started November 1. If you enroll by December 15, 2021, coverage starts January 1, 2022. If you enroll between December 16, 2021, and January 15, 2022, coverage starts February 1, 2022. A good resource is Healthcare.gov. If you are 65 or older, every year from October 15 through December 7th, Medicare beneficiaries can review the upcoming year Medicare health and drug plan offerings and make a plan switch if they choose to do so. Changes become effective on January 1, 2022. In certain cases, consumers may qualify for a special needs plan or other Medicare health and drug plan offering additional benefits. These plans may allow enrollment at different times during the year. Review the Medicare and You Handbook for more details.

It is almost time to close the books on 2021. Now is the time to take advantage of smart financial moves that can reduce your 2021 taxable income and position you for financial success in 2022 and beyond. Call us at (410) 840-9200 to get started.

Sources:

CNBC/ Schwab/ Forbes/ Kiplinger/ Healthcare.gov/ Medicare.gov

CNBC. (September 2021). These Year-End Tax Moves May Help You Save, Regardless of What Happens in Congress.

Consider these year-end tax moves, regardless of what Congress does (cnbc.com)

Schwab. (September 2021). How to Cut Your Tax Bill with Tax-Loss Harvesting.

Reap the Benefits of Tax-Loss Harvesting (schwab.com)

Forbes. (August 2021). How to Donate Your RMD Using Qualified Charitable Distributions.

How To Donate Your RMD Using Qualified Charitable Distributions (forbes.com)

Kiplinger. (October 2021). Tax Withholding Adjustments Can Boost Your Paycheck Now and Avoid Penalties Later.

Tax Withholding Adjustments Can Boost Your Paycheck Now and Avoid Penalties Later | Kiplinger

Main Street Advisors, LLC November 2021. Main Street Advisors, LLC is a Registered Investment Advisor. The articles & opinions expressed in this material were gathered from a variety of sources, but are reviewed by Main Street Advisors, LLC prior to its dissemination. All sources are believed to be reliable but do not constitute specific investment advice. The views expressed are those of the firm as of November 2021 and are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice. Any advice given is general in nature and investors must consider their own individual circumstances. In all cases, please contact your investment professional before making any investment choices. Main Street Advisors, LLC is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.