What we do best is instill “money confidence” in our clients through our advisory services so that they sleep well at night. Not only do we manage investments for our delegator clients, we also assist them in making smart decisions as we integrate the other key areas of financial planning: cash flow/income sourcing, risk management, tax reduction, retirement planning, and estate planning. The proper coordination of one’s investments with the other areas of financial planning is crucial to the long-term effectiveness and efficiency of one’s “money”. Our clients can expect a full-service approach as we always view finances using a 360-degree lens paying close attention to detail every step of the way.

Our firm provides continuous advice to clients regarding investment decisions based on the specific needs of the client. Through personal discussions in which goals, objectives, preferences, time horizon and risk tolerance are established, we develop a client’s personal investment plan and build and manage a portfolio based on that plan. Main Street Advisors is always here to help with your investment planning in Westminster and beyond.

Our investment recommendations are not limited to any specific product or service offered by a broker-dealer or insurance company and will include advice including but not limited to:

| Model Name | Allocation | Description |

|---|---|---|

| Conservative Growth & Income | 20% equities/80% fixed income | Much lower risk/return profile than the Balanced Growth & Income model. While never guaranteed, we expect this model's average annual rate of return over the next ten years to approximate 4% net of fees. We also estimate its maximum three month-decline to be -5%, but cannot guarantee that this threshold won't be exceeded. This portfolio is most appropriate for investors who have very short time horizons and who value short-term capital preservation over higher long-term returns. |

| Moderate Growth & Income | 40% equitiies/60% fixed income | Lower risk/return profile than the Balanced Growth & Income model. While never guaranteed, we expect this model's average annual rate of return over the next ten years to approximate 5% net of fees. We also estimate its maximum three month-decline to be -10%, but cannot guarnatee that this threshold won't be exceeded. This model is appropriate for investors who are uncomfortable with higher short-term risk and who value short-term capital preservation over higher long-term returns. |

| Balanced Growth & Income | 60% equities/40% fixed income | High risk/return profile similar to that of most pension plans. While never guaranteed, we expect this model's average annual rate of return over the next ten years to approximate 6% net of fees. We also estimate its maximum three-month decline to be -16%, but cannot guarantee that this threshold won't be exceeded. The higher downside risk threshold allows us to have more equity exposure than in our conservative balanced portfolio, while remaining relatively conservative. This portfolio is appropriate for investors who want to participate in the equity markets but are still somewhat uncomfortable with short-term risk. |

| Capital Growth & Income | 80% equities/20% fixed income | Higher risk/return profile than the Balanced Growth & Income model. While never guaranteed, we expect this model's average annual rate of return over the next ten years to approximate 7% net of fees. We also estimate its maximum three month-decline to be -23%, but cannot guarantee that this threshold won't be exceeded. This portfolio is more aggressive, with an 80% default allocation to equities and is appropriate for investors who are willing to accept higher short-term risk in exchange for the chances of higher long-term returns than what are available from our more conservative models. |

| Aggressive Growth | Primarily all equities | This portfolio is a fully invested, global stock portfolio. The volatility of the portfolio's returns will be as wide as the equity market's. Along with higher risk, we expect higher long-term returns than what are available from our other, less aggressive models. This portfolio is appropriate for investors with a long time horizon and no concerns about short-term risk. |

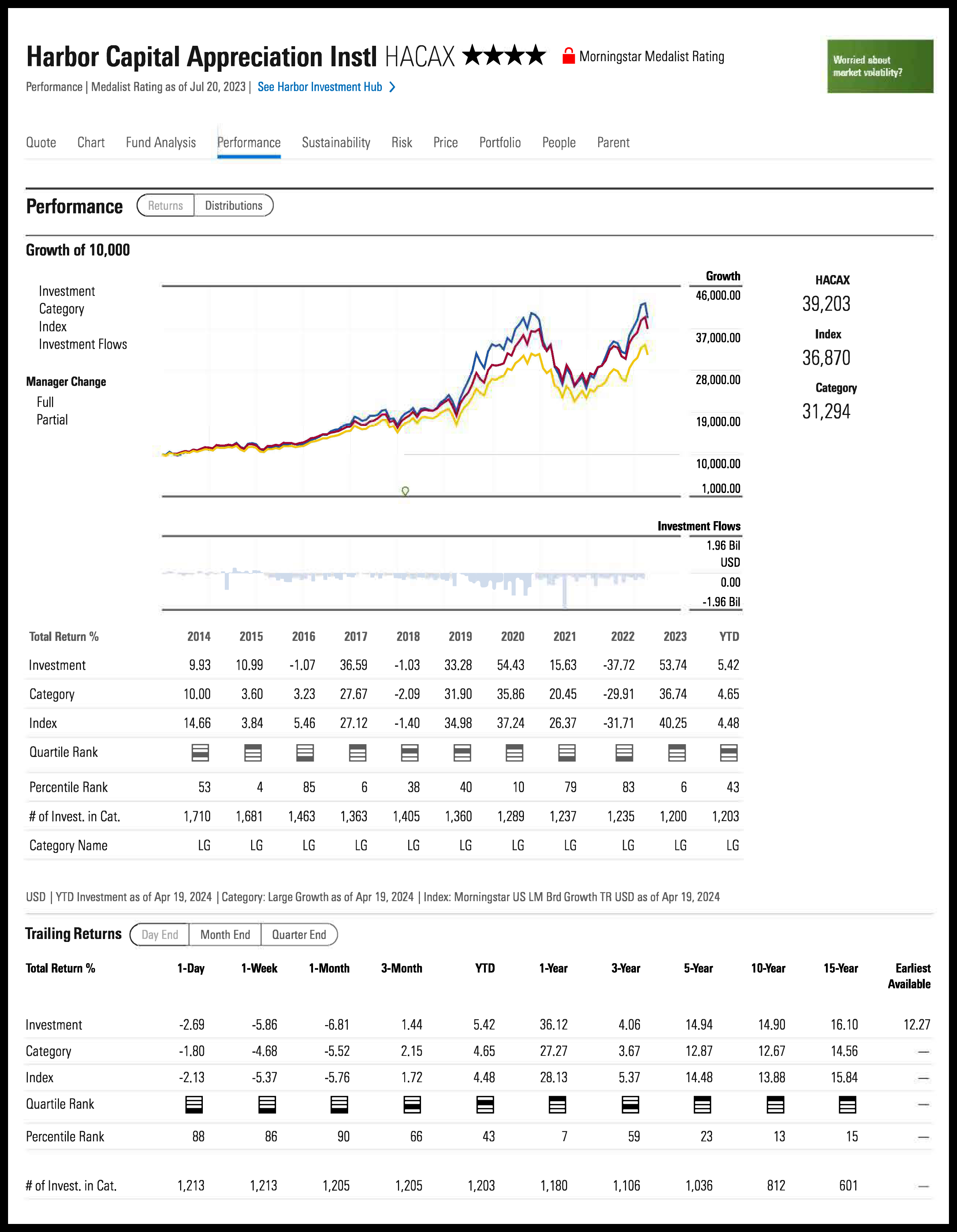

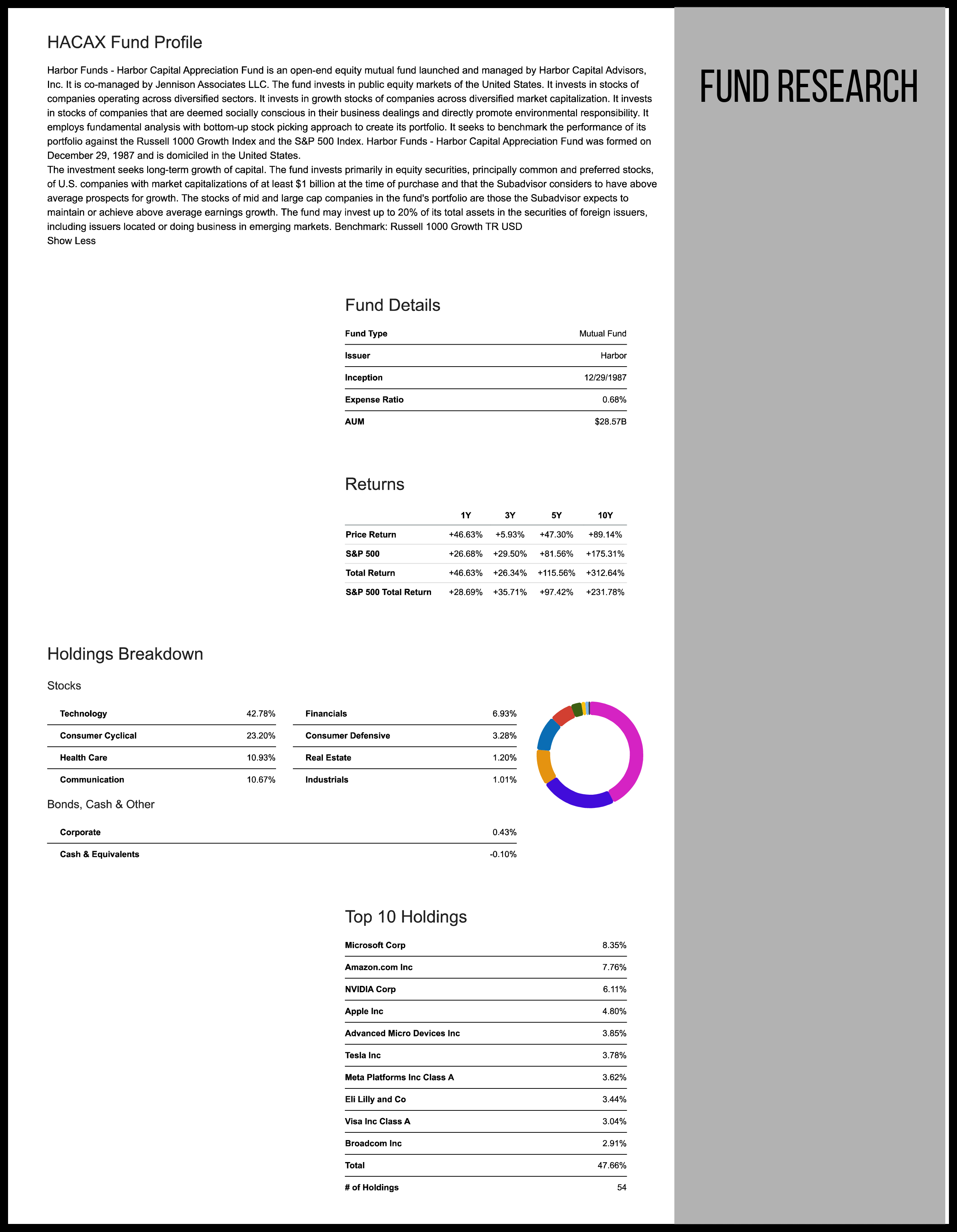

We use a two-pronged approach regarding our research and analysis. Main Street Advisors, LLC utilizes the in-depth research and extensive knowledge of industry recognized Kwanti, as well as other resources such as Morningstar and Seeking Alpha, in addition to carefully vetting investments internally using our own due diligence process. A comprehensive due diligence analysis is performed, including review of the fund’s commentary, strategy, manager(s), portfolio construction, historical performance and more.

To ensure the portfolio remains suitable and the account continues to be managed in a manner consistent with our client’s specific financial circumstances, we provide periodic check in’s with clients, at least annually to determine whether there have been any changes in the client’s financial situation, investment objectives, risk tolerance, etc. Our door is always open for our clients and we encourage our clients to call with questions any time. Performance reports are sent quarterly to all clients, and a weekly market update is sent to those clients who choose to receive it.

Main Street Advisors has been navigating the financial markets in our home office in Carroll County, Maryland for over 20 years. As a true fee-only registered investment advisor fiduciary, we take this responsibility very seriously. We always put our client’s interests first and treat them with the honesty and respect they deserve.